How using data helps banks minimize the risks of loan default

Traditional credit risk management depends on reliable client scoring each time someone asks for a new loan product. Such a procedure is a standard and proven process, and it will surely remain so for many years to come. This article describes how new data-driven methods can help make standard risk scoring more precise and even improve the credit risk monitoring of banking clients overall.

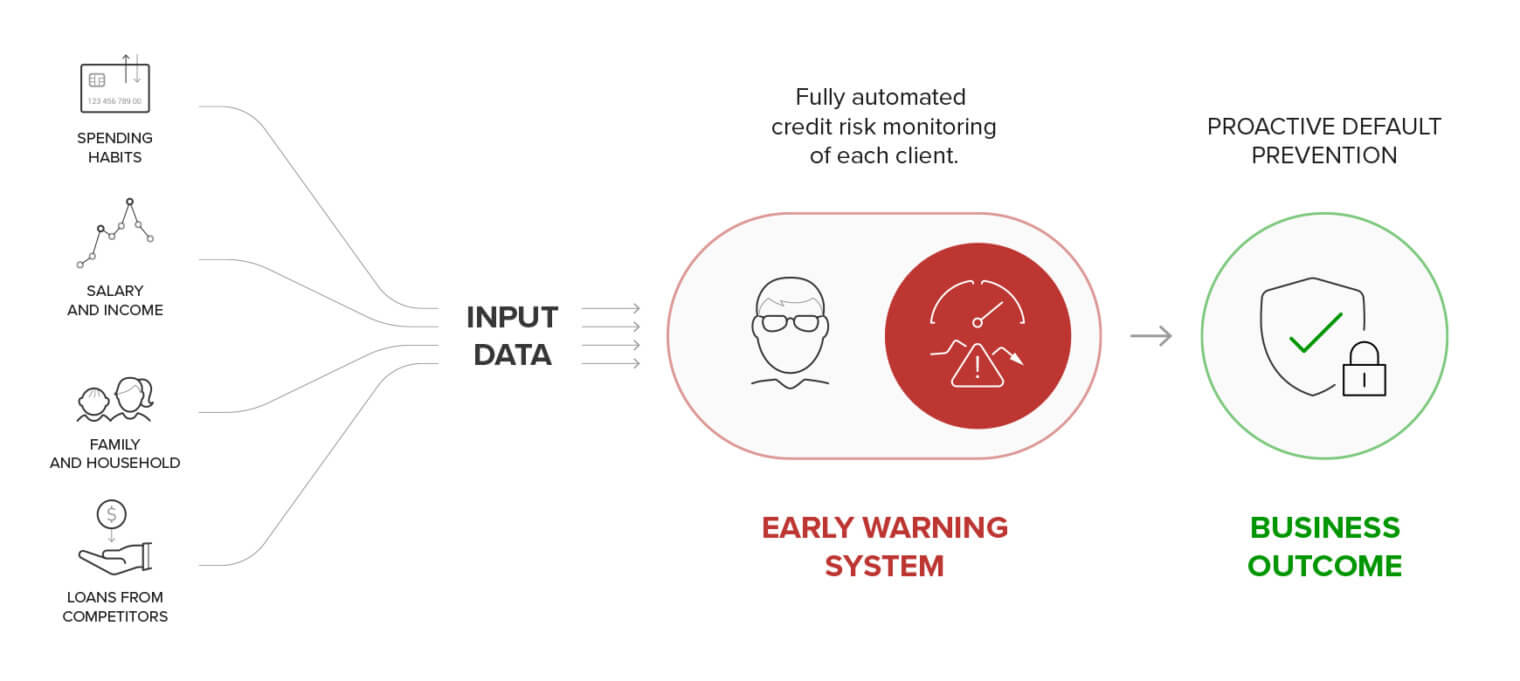

Shifting from reactive to proactive credit risk monitoring

The main idea of data-driven credit risk monitoring is to be able to check the creditworthiness of each individual customer on an ongoing basis. This is something that seems very challenging with a standard risk scoring mechanism.

However, it is possible to execute such demanding procedures—and almost in real-time—by using big-data processing technology on a daily basis. This makes it possible to act proactively as soon as the client’s situation changes.

Client situations leading to an actual increase in credit risk that might be detected beforehand:

- Job change/loss

- Income shortage

- Higher expenditures

- New loans (e.g., provided by non-banking organizations)

- Changes in the household

- Changes in the social environment

In other words, regular assessment of client credibility enables you to detect potential future issues and intervene at the earliest opportunity so there are more options for remedying the situation and avoiding losses.

Data-driven assessments run automatically and monitor customer behaviour, working as what we call an early warning system. This means that customers with financial difficulties will be flagged sooner rather than later and issues can be addressed before they arise—and before the customer defaults.

The credit risk early warning system enables banks to:

- Anticipate defaults and solve problems in advance

- Deal with a vast number of loan clients, many of whom could be

in danger of not being able to repay their debt - Avoid reacting to the situation only after the client has missed

his or her repayment date

Improving the scoring process

Data models work with clients’ historical data, specifically the transaction history from which advanced client features can be derived. This allows you to determine patterns of behaviour that could lead to a future inability to make repayments.

Behavioural models examine many client characteristics, but the following increase its predictive power significantly:

- Changes in spending habits

such as increased spending and cash withdrawals are the most significant behavioural symptom. It is necessary to detect these changes and react as soon as they occur. - Salary and income

are other important characteristics that reveal information about a client’s work life. Identifying clients’ regular sources of income, wages and bonuses and detecting their pay cuts or raises is key to assessing their income stability for proactive risk scoring. - Family and household

say a lot about a client’s background. Detecting which clients are part of the same household (family members, fiancés, people in long-term relationships or friends and flatmates) is a way to efficiently assess the credit risk of household members jointly. - Instalment payments

going to loans obtained from other banking and non-banking organizations must be recognized so you can prevent the potential risk of default and even offer debt consolidation.

Keynotes

- Automate your scoring mechanism using predictive models and move from reactive to proactive credit risk management.

- Monitor your clients’ transactions in real-time for suspicious behaviour like overspending or increased withdrawals.

- Be notified of each individual client’s job and salary changes.

- Make use of information about your clients’ backgrounds and households, and be able to monitor their financial behaviour as a whole.

- Recognize when clients are making repayments with money from other loans to prevent the risk of default, and discover opportunities to offer debt consolidation.